Suppose you want to sell your mortgage note and you have been receiving payments for 12 months. The monthly payment of $510.00 represents both the principal and interest on the your owner financed note, which will pay off in 30 years (360 payments). Each month as payments are made the remaining balance is reduced.

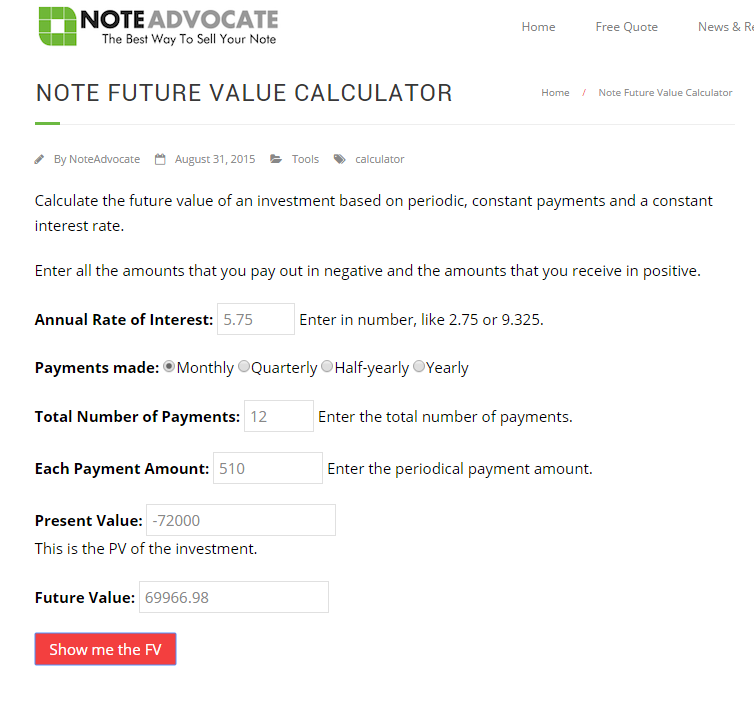

Using Note Future Value Calculator can help you calculate the remaining balance.

If the property original sale price was $80,000 and down payment was $8,000 or 10 percent, you can find the present value: $80,000.00 – $8,000.00 = $72,000.00.

Use present value with a “-” (negative) sign. Input an annual interest rate 5.75 and monthly payment $510.00. Number of periods should be 12, as mentioned above.

The current balance on a seasoned mortgage note would be $69,966.98.

Why is PV (Present Value) Negative?

There are two sides of a private mortgage note transaction. Most people are familiar with being the borrower. If you are the borrower, you have a positive present value because you’ve received a lump sum of cash (financing from the note owner) which was used to purchase the real estate asset. Using the calculator with a positive PV will results in a negative FV. The FV represents the total balance owed, or will have been paid, when the private mortgage note is completely satisfied.

On the flip side, you can look at the same private mortgage note from the perspective of the lender (owner or bank). As the owner of a private mortgage note, you have essentially lent a lump sum of cash to the borrower. This explains why your present value is negative. Each payment amount to you as the owner of a private mortgage note is an inflow so it is positive. The estimated FV is the total amount of money you will receive at the end of the private mortgage note term.