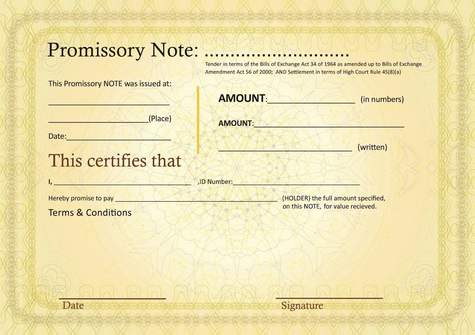

Promissory Note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date. A promissory note usually includes the principal amount, the interest rate if any, the parties, the date, the terms of repayment (which could include interest), the maturity date, and issuer’s signature.

All business loans secured from a bank or other lending institution have some sort of promissory note, but they are also recommended for loans between two individuals (even if the loan is between family members or close friends) to avoid any misunderstandings or possible legal troubles.

A mortgage note is a type of promissory note that is secured by a mortgage loan. The borrower agrees to pay the lender back the principal plus interest over a certain period of time in regular installments. If the borrower fails to pay back the mortgage, the lender can accelerate the debt, meaning that the entire debt becomes due.

The Difference

A promissory note is commonly unsecured, which just means that it’s not attached to a physical piece of property. A mortgage loan is a secured debt, meaning that the amount borrowed is backed by the real estate property the borrower purchases.

NoteAdvocate is a free platform providing tools and resources designed to equip note sellers through the mortgage note selling process. Submitting a request into our industry leading Mortgage Note Matching Engine, of course, is the Best Way to Sell Your Note.